History

2025

2025

- In February, ZIN won the first prize in the Best Commercial Development category at the RES Awards.

- In April, our Pacheco building came to life. The building is now evolving into a multifunctional urban hub integrating offices, coliving, hospitality, and retail spaces.

- May marked a new milestone for ZIN with the opening of The Standard Brussels, a luxury hotel located within ZIN, where guests can stay, enjoy lunch or take in the view from Lila29, our rooftop bar and restaurant. Both venues have already become must-visit destinations in the city.

- In June, Befimmo and the European Commission signed a long-term usufruct agreement for the LOOM building. Under this agreement, the European Commission will move into the building at the end of 2026 for a period of 18 years.

- In addition, the transformation of Pleinlaan in Ixelles began on 17 June 2025, marked by the symbolic laying of the first stone. Soon, the site will evolve into a hub for education, sports, culture, and community life in the heart of the city.

- At the end of the month, we also celebrated Befimmo’s 30th anniversary at ZIN, with a programme that included a guided tour of the entire building, from the greenhouse, through the offices and residential units, to the hotel.

- In September, we published our first Befimmo Office Barometer. It reveals which types of workspaces ensure employee retention and attract young graduates.

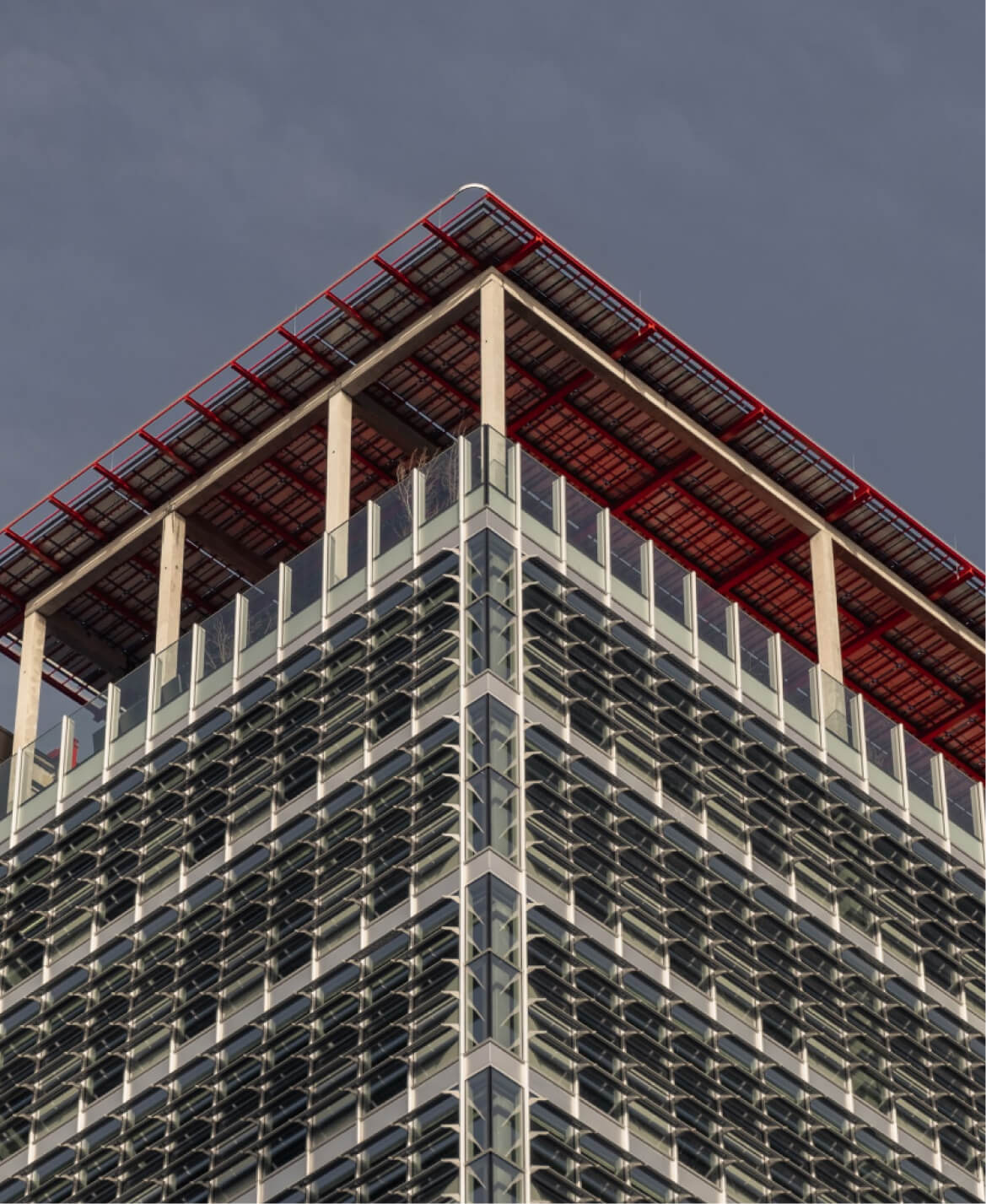

- At the end of the year, ZIN was named “World’s Best Tall Building 2025” by the Council on Vertical Urbanism (CVU), often described as the “Oscars of skyscrapers.” At the same time, our subsidiary Silversquare achieved B Corp certification.

2024

- In February, the delivery and lease start of ZIN to the Flemish Government marked a major step forward for this flagship project. That same month, Silversquare also opened its 12th coworking space in Louvain-la-Neuve.

- Launch of NABS, our in-house design practice which moved to the Central building a few months later.

- In May, Thijs Simoens, our new Chief Legal Officer joined Befimmo, introducing a more structured approach to legal support by appointing a dedicated internal legal counsel to each building and project. Meanwhile, the start of the lease with Habyt at ZIN marked its entry into the Belgian market, adding 111 residential units of various sizes to this flagship development.

- In July, the building permit was submitted for our Empereur building, which will be transformed into a high-performance, sustainable workspace.

- The start of the interior and exterior dismantling and demolition work for our LOOM project began in August.

- After interior stripping in May and the permit submission in June, PLXL reached a major milestone in September with its official launch. Interior clearing and demolition were underway, setting the stage for the next phase of development.

2023

- As part of its new strategy and financing structure, the Befimmo group underwent a legal reorganization in 2023. More specifically, all the assets and liabilities of Fedimmo SA were transferred to Befimmo SA as part of a merger completed on 31 October 2023. Following this operation, Fedimmo SA was dissolved without liquidation. Then, on 1 November 2023 (00:00), Befimmo SA was demerged, by virtue of which all its assets and liabilities were transferred to several companies in the Befimmo group. As a result, Befimmo SA ceased to exist following its dissolution without liquidation. Following the legal reorganization, the group's new holding company is Befimmo Group SA (FIIS).

- As part of the group's assets rotation plan, Fedimmo SA sold 6 of the properties in its real estate portfolio.

- Alexandrite Monnet Belgian Bidco SA - an entity wholly controlled by one of Brookfield’s real-estate private funds - acquired control of 100% of Befimmo SA following the simplified squeeze-out and Befimmo SA has left the stock market on 3 January 2023 after close of trading.

Fair value of portfolio at 31 December 2023

2022

- The start-up Sparks opened its doors on 1 June in Brussels (in Central, Befimmo’s headquarters).

Asset Rotation

- Befimmo sold two non-core buildings in Belgian provincial towns (Brugge and Torhout Burg).

- Befimmo signed the early termination of the leasehold rights for the Choux building, located in the Centre of Brussels.

- In December, Befimmo sold full ownership of the Ocean House building, located in the Periphery of Brussels, to a private investor.

- As part of the group's assets rotation plan, Fedimmo SA sold 24 of the properties in its real estate portfolio.

Coworking

- In April, Silversquare opened its ninth coworking space in the Quatuor complex in the North district of Brussels.

- In September, Silversquare opened its tenth coworking space in the Paradis Express in Liège. Just a stone's throw from the famous Guillemins train station.

ESG

- Following the comprehensive review of its carbon footprint and the integration of all of its subsidiaries in accordance with the GHG Protocol, Befimmo obtained the validation of its Science Based Targets (SBT). Via these targets, the Company undertakes to reduce absolute CO2e emissions related to scopes 1 and 2 by 50% by 2030, compared to the base year 2018.

Fair value of portfolio at 31 December 2022

2021

- On 27 April, Jean Philip Vroninks is appointed as Executive Director by the General Meeting of Shareholders. He officially began his mandate as CEO of Befimmo on 1 June 2021.

- Implementation of Befimmo’s Green Finance Framework, which provides supporting structure on which Befimmo can issue Green Bonds.

- Befimmo partners up with Sparks. The start-up will offer special meeting environments featuring innovative meeting rooms, a range of complementary services and professional support.

- Befimmo moved to its brand new flagship offices in the Central building.

Developments

- Delivery of the Quatuor building with its first occupants moving in in August 2021.

Asset rotation

- Acquisition of the Cubus building in Howald, Luxembourg for approximately €30 million. This second investment in the Grand Duchy of Luxembourg offers an important value creating potential.

- Granting of a 94-year long lease on the office building of the “Esprit Courbevoie” project, in state of future completion, for an amount of approximately €27 million. The expected yield on investment is 5.6%.

- Disposal of the Wiertz building to its occupant, the European Parliament, for a total amount of €74.9 million. The operation generated a net capital gain of €43.2 million on the investment value.

- Acquisition of the second, third and fourth floors (5,600 m²) of the Antwerp Tower in which Silversquare will operate a coworking space.

Coworking

- Opening of an eighth coworking location: Silversquare Central, located in the heart of Brussels.

Fair value of portfolio at 31 December 2021

2020

- Befimmo announces its partnership with Co.Station (a unique innovation and entrepreneurship platform) and becomes its privileged real-estate partner.

- Befimmo celebrated its 25th birthday.

Development

- The ZIN project obtains building and environmental permits.

Asset rotation

- Granting of a 99-year leasehold on the Blue Tower for a total amount of about €112 million, with a net capital gain of some €22 million on the investment value.

- Disposal of the Media, Guimard, Froissart, Schuman 3 and Schuman 11 buildings. Based on investment value the transactions generated an overall net capital gain of some €35 million.

ESG

- Introduction of our Breathe at Work label.

- Befimmo joins the community of the Belgian Alliance for Climate Action, founded by The Shift and WWF. Together with 52 other Belgian companies, Befimmo is committed to reducing its CO2e emissions by introducing Science Based Targets (SBT).

Fair value of portfolio at 31 December 2020

69 m € raised following the private placement of 1,266,300 treasury shares.

Developments:

- Befimmo completes the largest rental transaction on the Brussels office market since 10 years. It wins the public contract organised by the Flemish Government. The 70,000 m² of office space in the ZIN project is entirely pre-let. The 18-year lease will commence in 2023. The ZIN project won the “be.exemplary 2019” award, organised by the Brussels authority (“Urban.brussels”) in the category “Large private projects”.

- Paradis Express: Befimmo and Matexi (residential developer) signed a cooperation agreement for the transfer of part of the land (0.6 ha) to be developed by Matexi who will handle the development of the residential spaces, shops and hospitality businesses.

Asset rotation

- Disposal of the Pavilion building, located in the Brussels CBD (Leopold district), generating a capital gain of €10.0 million (€0.39 per share) in relation to the fair value as the fiscal year opened.

- Acquisition of the Loi 44 building, adjacent to Befimmo's Joseph II building it offers great potential for value creation.

Coworking

- Opening of the Silversquare Zaventem coworking space in Ikaros Park.

Fair value of portfolio at 31 December 2019

Developments

- Finalisation of the integration of the Arts 56 building (22,000 m²) into the portfolio.

- Start of the permit application process for the ZIN project.

- Renovation of the Brederode Corner building: winner of the Be Circular Editions 2018 competition. The building (7,000 m²) is fully let two years before handover.

Coworking

- Strategic acquisition of Silversquare, leader and pioneer of coworking on the Belgian market.

- Opening of a Silversquare coworking space in the Triomphe building.

Fair value of portfolio at 31 December 2018

Developments

- Beobank, first major tenant of the Quatuor.

- Befimmo concluded a strategic partnership with the Belgian leader in coworking, Silversquare.

- Evolution of the company strategy based on the United Nations Sustainable Development Goals.

Fair value of portfolio at 31 December 2017

Developments

- Capital Increase of €127 million

- Price of the MIPIM “Best Futura Project Award” for the Paradis Express project

Fair value of portfolio at 31 December 2016

Befimmo celebrates its 20-year anniversary

Asset rotation

- Acquisition of the Gateway building, let for 18 years to Deloitte

Fair value of portfolio at 31 December 2015

Status change from Sicafi to public BE-REIT

Development

- Handover of the Paradis Tower in Liège, start of the 27.5-year lease with the Buildings Agency

Fair value of portfolio at 31 December 2014

Developments

- Integration of property management business

Asset rotation

- Acquisition and merger of Blue Tower Louise SA (owner of the Blue Tower building, located in the Louise district in Brussels) and private placement of 637,371 shares

- Contribution in kind of the AMCA building in Antwerp by AXA Belgium SA and issue of 2,037,037 shares

ESG

- ISO 14001 recertification of the Environmental Management System (EMS)

- Completion of Befimmo’s materiality matrix to continue improving the positioning as a responsible company and owner

- First communication according to the new GRI-G4 guidelines

Fair value of portfolio at 31 December 2013

US Private Placement (USPP) for an amount of €150 million and buyback programme of own shares

Developments

- Start of the construction works of the new Finance center, Paradis Tower, in Liège

- Transformation of Befimmo SCA into a Limited Liability Company

ESG

- First BREEAM Post-Construction and In-Use certification

Fair value of portfolio at 31 December 2012

Bond issues for an amount of €272 million

Asset rotation

- Acquisition of the shares of Ringcenter SA (Pavilion)

ESG

- First EPB certification (Energy Performance of Buildings)

Fair value of portfolio at 31 December 2011

ESG

- First BREEAM Design certification

- Start of the telemonitoring installation for energy consumption in the buildings of the portfolio

- Set-up of an Environmental Management System (EMS) (ISO 14001 certified)

Fair value of portfolio at 30 September 2010

Capital increase of €166.6 million

First communication as per Global Reporting Initiative (GRI)

Fair value of portfolio at 30 September 2009

Acquisition of the regional headquarters of Fortis Bank in Antwerp (Meir) and Leuven (Vital)

Fair value of portfolio at 30 September 2008

Befimmo acquired the as yet uncompleted phase V of the Ikaros Business Park

Capital increase of €261.2 M

Fair value of portfolio at 30 September 2007

2006

- Acquisition of a 90% shareholding in Fedimmo SA

- The portfolio of this company then comprised 62 office buildings let to the Belgian Government’s Buildings Agency. They housed the Federal Public Services, essentially the Ministries of Finance and Justice. The total floor area of this portfolio was around 382,000 m². At 31 December 2006 its investment value was €725 million.

- Acquisition of the Axento project

Fair value of portfolio at 30 September 2006

Acquisition of the Poelaert building

Value of portfolio at 30 September 2003

Takeover of Sicafi CIBIX SCA

Value of portfolio at 30 September 2001

Acquisition of various buildings

Befimmo acquired the as yet uncompleted phases III and IV of Ikaros Business Park

Befimmo carried out a merger by takeover of Wetinvest SA, owner of the Media office building, at Medialaan in Vilvoorde

Befimmo acquired three buildings indirectly: Triomphe, Wiertz, Van Maerlant

Value of portfolio at 30 September 2000

Takeover of Noord Building SA

Value of portfolio at 30 September 1998

Merger with Prifast

Befimmo’s General Meeting of 19 September 1997 decided to merge with Prifast

Value of portfolio at 30 September 1997

1996

By the end of its first year of operation, in September 1996, Befimmo had already assembled a property portfolio with a total area of 90,000 m² and worth €159 million.

Foundation of Befimmo and listing on the stock market

On 30 August 1995, “Woluwe Garden D SA” was founded, a subsidiary of the Bernheim-Comofi group, with the mission of buying and letting buildings. The Bernheim-Comofi group decided to expand its subsidiary’s property portfolio, which was then renamed Befimmo and converted into a Société en Commandite par Actions. On 29 November 1995, Befimmo was approved by the Banking, Finance and Insurance Commission: the first Belgian fixed-capital real-estate investment trust (Sicafi) was introduced on the stock market.