Strategy

Our vision

Befimmo aims to create, build & animate thriving Work & Life communities for a sustainable future.

Our ambition is to create and operate high-quality, mixed-use projects in growing economic, academic and research hubs in BeLux.

We envision places where all users can enjoy a pleasant, safe and connected work experience, with a focus on hospitality as a booster of inspiration, well-being and productivity.

Befimmo’s priority of creating value is about offering integrated hybrid, sustainable work & life solutions answering to the major trends shaping today, the world of tomorrow. ESG criteria have become a natural extension to this strategy and drives us towards innovation.

Our mission

Our mission is to invest in, develop & operate green work and life ecosystems in growth cities while creating value for our stakeholders.

Our buildings are user-centric, high-quality, ideally located, sustainable, mixed-use and respond to the highest standards in terms of performance and flexibility.

We aim to provide “workspace-as-a service” to our users, through a wide range of solutions.

The way we work and live is changing. We aim to accompany this change and offer our users an unrivalled client-experience.

Our business model

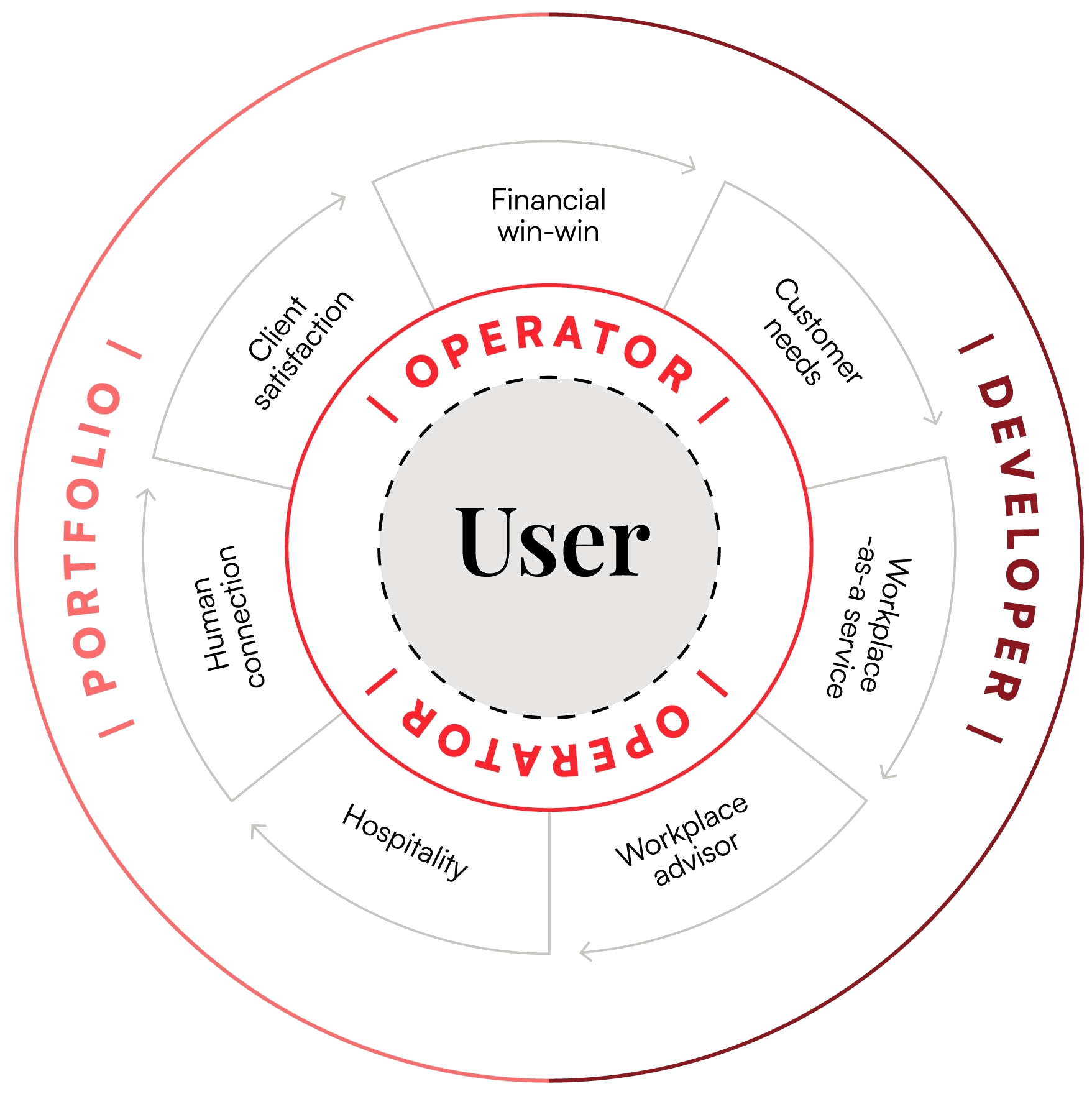

Befimmo is shifting to a user-centric business model. In the course of 2022, we have reorganised Befimmo in three business lines:

- PORTFOLIO: Creating value by investing in and managing work and life hubs in growth cities

- OPERATOR: Creating value by operating and designing work and life hubs that meet user needs and offer an ultimate experience

- DEVELOPER: Creating value by developing sustainable, SMART and high-performance buildings